The Hidden Fragmentation Tax in Financial Services

In financial services, operational fragmentation is more than an IT inconvenience. It is a direct threat to profitability, compliance readiness, and client trust.

When accounting systems, portfolio tools, CRMs, and reporting platforms operate independently, finance teams spend their time reconciling numbers instead of analyzing performance. Leadership ends up making strategic decisions using outdated data, and compliance preparation becomes reactive and stressful.

In our experience working with financial firms, fragmented systems quietly consume up to 40% of finance capacity. Month-end closing stretches beyond ten days. Reporting accuracy depends on manual validation. What appears to be a systems issue becomes a growth constraint.

ERPNext replaces disconnected tools with a unified operational foundation. Finance, compliance, and client operations operate within a single real-time environment, creating consistency, control, and transparency across the organization.

At Gnosys Digital, we design and implement ERPNext environments specifically for financial services firms that require strong governance, scalable operations, and continuous compliance readiness. The result is not just system consolidation. It is operational control built for growth.

The Real Cost of Fragmentation

Operational fragmentation often remains invisible until it begins directly impacting financial performance, compliance readiness, and leadership decision-making. What starts as manageable system complexity gradually turns into measurable operational drag.

In financial services firms, the impact typically shows up in five areas:

1. Finance Capacity Erosion

Up to 40% of the finance team’s time is consumed by reconciliation and data consolidation across disconnected systems. Instead of delivering analysis and forward-looking insight, teams become operational processors.

2. Escalating Compliance Pressure

When financial records, approvals, and documentation live across multiple platforms, compliance reporting slows. Audit preparation becomes reactive, increasing both regulatory risk and internal stress.

3. Reporting Errors and Client Risk

Manual data handling increases the likelihood of inconsistencies in client and portfolio reporting. Even small discrepancies can undermine credibility in advisory and investment environments.

4. Extended Closing Cycles

Month-end and quarter-end closing processes depend on manual aggregation across systems. This delays accurate financial visibility and reduces leadership’s ability to respond quickly to performance trends.

5. Decision-Making on Historical Data

When reporting lagging operations, executives are forced to act on outdated financial views rather than real-time performance indicators.

Individually, each issue appears operational. Collectively, they restrict growth, increase compliance exposure, and limit strategic agility. What begins as system fragmentation ultimately becomes a structural constraint on the business.

From Fragmented Operations to Unified Control

Most financial firms attempt to solve operational friction by adding more tools. Over time, that approach increases complexity instead of reducing it.

ERPNext replaces layered systems with a unified operational architecture. Finance, operations, and client management operate within a single data model, eliminating duplication, inconsistencies, and manual reconciliation. The result is structural clarity rather than incremental patchwork.

This shift moves organizations from reactive processing to controlled, data-driven execution.

| Operational Challenge | ERPNext Solution | Business Outcome |

|---|---|---|

| Finance teams spend excessive time reconciling data across systems | Centralized accounting supported by automated workflows | Finance teams focus on financial analysis and strategic planning rather than manual reconciliation |

| Month-end closing is slow and unpredictable | Real-time consolidation and automated reporting | Closing cycles reduced from more than 10 days to under 3, enabling faster financial visibility |

| Compliance preparation becomes a recurring crisis | Centralized documentation with complete audit trails | Continuous audit readiness replaces last-minute compliance pressure |

| Client profitability remains unclear across services and portfolios | Integrated billing, CRM, and accounting within one system | Accurate profitability visibility by client, service, and portfolio |

| Leadership lacks real-time performance insight | Live dashboards and integrated financial analytics | Faster, data-driven decisions across departments |

By removing operational silos, firms move from fragmented workflows to unified control. Instead of chasing data across systems, leadership operates from a single source of truth aligned with financial, operational, and compliance objectives.

From Reconciliation Chaos to Real-Time Visibility

When financial data lives across disconnected systems, reconciliation becomes a constant background task. ERPNext eliminates that dependency by centralizing accounting, billing, expense management, budgeting, and reporting within a single operational environment.

Instead of consolidating numbers at month-end, firms operate from continuously updated financial records.

Organizations gain:

- Automated Financial Workflows

Routine financial processes such as journal entries, billing, expense allocation, and reconciliations are automated, allowing finance teams to spend less time on operational tasks and more on analysis. - Multi-Entity Financial Control

Firms operating across multiple entities or jurisdictions can manage accounts within one system while maintaining proper entity-level controls and consolidated financial visibility. - Live Financial Performance Visibility

Leadership gains immediate access to updated financial data across departments, services, and portfolios, enabling faster and more confident decisions. - Predictable Closing Cycles

Automated consolidation and standardized workflows reduce delays, making closing processes shorter and more reliable.

As a result, finance leadership moves away from reactive reporting toward proactive financial planning and data-driven decision-making.

Audit-Ready from Day One

When financial transactions, approvals, and supporting documents exist in a unified, traceable system, compliance moves from reactive to continuous. Instead of scrambling across departments during audits, organizations maintain readiness every day through structured operational controls.

ERPNext provides:

- Complete transaction audit trails

Every financial and operational transaction is recorded with timestamps, user details, and change histories, ensuring full transparency and traceability for auditors. - Structured approval workflows ensure accountability

Configurable approval processes ensure financial and operational actions are properly reviewed and authorized, reducing compliance risk and improving process discipline. - Role-based access controls protecting sensitive information

Access to financial and operational data is governed by user roles and permissions, ensuring sensitive information is available only to authorized personnel. - Centralized document management supporting audit readiness

Contracts, invoices, compliance records, and supporting documents are stored in a centralized system, making retrieval quick and reliable during audits or compliance reviews.

As a result, audits shift from stressful, last-minute exercises to predictable and manageable processes supported by organized and accessible records.

Unified Client & Contract Management

Client contracts, billing cycles, and service delivery activities operate within a single operational environment in ERPNext, improving coordination between finance, sales, and client management teams. By eliminating disconnected tracking systems, organizations ensure billing accuracy and better service accountability.

Benefits include:

- Accurate automated billing workflows

Billing schedules, pricing structures, and service agreements are directly linked to client contracts, reducing manual billing errors and ensuring invoices are generated accurately and on time. - Clear visibility into contract lifecycles and renewals

Teams gain centralized visibility into contract start dates, renewal timelines, and service commitments, helping prevent missed renewals and revenue leakage. - Improved coordination between service delivery and billing operations

Service teams and finance teams operate on the same data, ensuring delivered services are accurately reflected in billing, improving client satisfaction, and revenue tracking.

This unified approach reduces revenue leakage while improving both operational efficiency and client experience.

Loan & Investment Tracking (Customizable)

Fragmented client, billing, and service data creates errors, delays, and lost revenue. ERPNext centralizes contracts, billing cycles, and service delivery within a single operational environment, aligning finance, sales, and client management teams.

The platform can support:

- Loan lifecycle management and tracking

Loans can be tracked from origination through disbursement, servicing, and closure, ensuring visibility into outstanding balances and loan status across portfolios. - Repayment scheduling and monitoring

Automated repayment schedules help teams monitor due payments, track collections, and identify overdue accounts, improving cash flow predictability. - Investment portfolio tracking

Investment records, capital allocation, and portfolio performance can be maintained centrally, providing structured oversight across multiple investments. - Asset and portfolio performance monitoring

Firms gain visibility into asset-level and portfolio-level performance, supporting better risk assessment and investment decision-making.

Workflows and reporting structures can be customized to match firm-specific financial models, operational processes, and regulatory requirements, ensuring the system adapts to business needs rather than forcing operational compromises.

Real-Time Dashboards & Leadership Reporting

Executives gain immediate access to live operational and financial insights through customizable dashboards within ERPNext. Instead of waiting for periodic reports, leadership teams can monitor performance in real time and respond quickly to operational and market changes.

Leadership teams can monitor:

- Profitability across portfolios and services

Revenue, cost structures, and margin performance can be analyzed across clients, portfolios, and service lines, providing clarity on which segments drive profitability. - Real-time cash flow visibility

Up-to-date views of receivables, payables, and cash positions help organizations manage liquidity and plan capital allocation more effectively. - Client and portfolio performance metrics

Performance indicators across portfolios and client engagements can be monitored continuously, improving reporting accuracy and client communication. - Operational KPIs across departments

Leadership gains visibility into operational performance metrics across finance, service delivery, and support teams, enabling faster corrective actions when needed.

As a result, decisions are made using live operational data rather than relying on outdated financial reports, improving responsiveness and strategic planning.

A Typical Financial Firm Transformation

Many financial services firms operate with processes that evolved but remain fragmented across multiple systems. Reporting, compliance tracking, and operational workflows often function in isolation, creating inefficiencies and delays.

ERPNext enables firms to transition from disconnected, manual operations to unified, real-time operational control.

Before ERPNext

- Client reporting required several days of manual data consolidation across systems

- Compliance documentation was scattered across departments and platforms

- Portfolio performance reports were frequently delayed due to data reconciliation efforts

- Month-end closing processes were stressful, time-consuming, and unpredictable

After ERPNext

- Client and portfolio reports are generated quickly using centralized, real-time data

- Compliance documentation is securely centralized and easily accessible

- Leadership gains instant operational visibility through live dashboards

- Closing cycles become shorter, smoother, and more predictable

Operational clarity replaces operational chaos, allowing leadership teams to focus on strategy, client value, and business growth instead of operational firefighting.

From Reporting Numbers to Guiding Strategy

ERPNext didn’t just accelerate our reporting cycles. It fundamentally changed how we engage with clients. With real-time portfolio visibility, our conversations moved from explaining what already happened to actively shaping future strategy. Clients now see us as proactive advisors rather than retrospective reporters.

— CFO, Wealth Management Firm

The Defining Metric

Financial services firms implementing ERPNext commonly reduce month-end closing cycles from more than 10 days to under 3 days.

This reduction from weeks to days does more than save time. It transforms the finance function from a historical record-keeper into a forward-looking strategic partner. Finance teams shift from chasing numbers to guiding strategic decisions, allowing leadership to respond faster to market changes and growth opportunities.

Traditional Systems vs ERPNext

| Traditional Approach | With ERPNext |

|---|---|

| Multiple disconnected systems managing finance and operations | Unified platform connecting finance, operations, and reporting |

| Manual data reconciliation across tools | Automated workflows reduce manual effort |

| Quarterly compliance preparation pressure | Continuous compliance readiness |

| Delayed financial reporting | Live dashboards with real-time insights |

| Vendor lock-in and rising licensing costs | Flexible and scalable platform |

Our ERPNext Implementation Approach

Gnosys Digital follows a structured ERPNext deployment methodology designed to minimize operational disruption while delivering measurable gains in financial control, reporting efficiency, and compliance readiness.

1. Operational Assessment

We assess current processes, reporting structures, and compliance requirements to identify inefficiencies, risks, and opportunities for improvement.

2. Solution Architecture

ERPNext modules are configured to reflect real business workflows, ensuring the system supports how teams actually operate rather than forcing process compromises.

3. Data Migration & Integration

Legacy systems and essential tools are integrated through a carefully planned migration strategy, preserving data integrity and historical accuracy.

4. Workflow Automation

Key workflows across billing, approvals, compliance tracking, and financial reporting are automated to reduce manual effort, operational risk, and dependency on spreadsheets.

5. Training & Adoption

Teams receive structured onboarding and role-based training to ensure rapid adoption and consistent system usage across departments.

6. Continuous Optimization

The system is continuously refined as operational needs evolve, ensuring ERPNext remains aligned with growth, regulatory changes, and business strategy.

Who Benefits Most?

ERPNext implementation delivers the greatest impact to organizations that require strong financial control, operational visibility, and continuous compliance readiness.

Organizations that typically see the highest value include:

- Financial advisory firms

- Investment management companies

- Lending organizations and NBFCs

- Wealth management firms

- Financial consulting organizations

- Multi-entity financial groups operating across regions or business units

By unifying finance, operations, and reporting, ERPNext enables these firms to scale confidently while maintaining financial discipline, operational transparency, and compliance control.

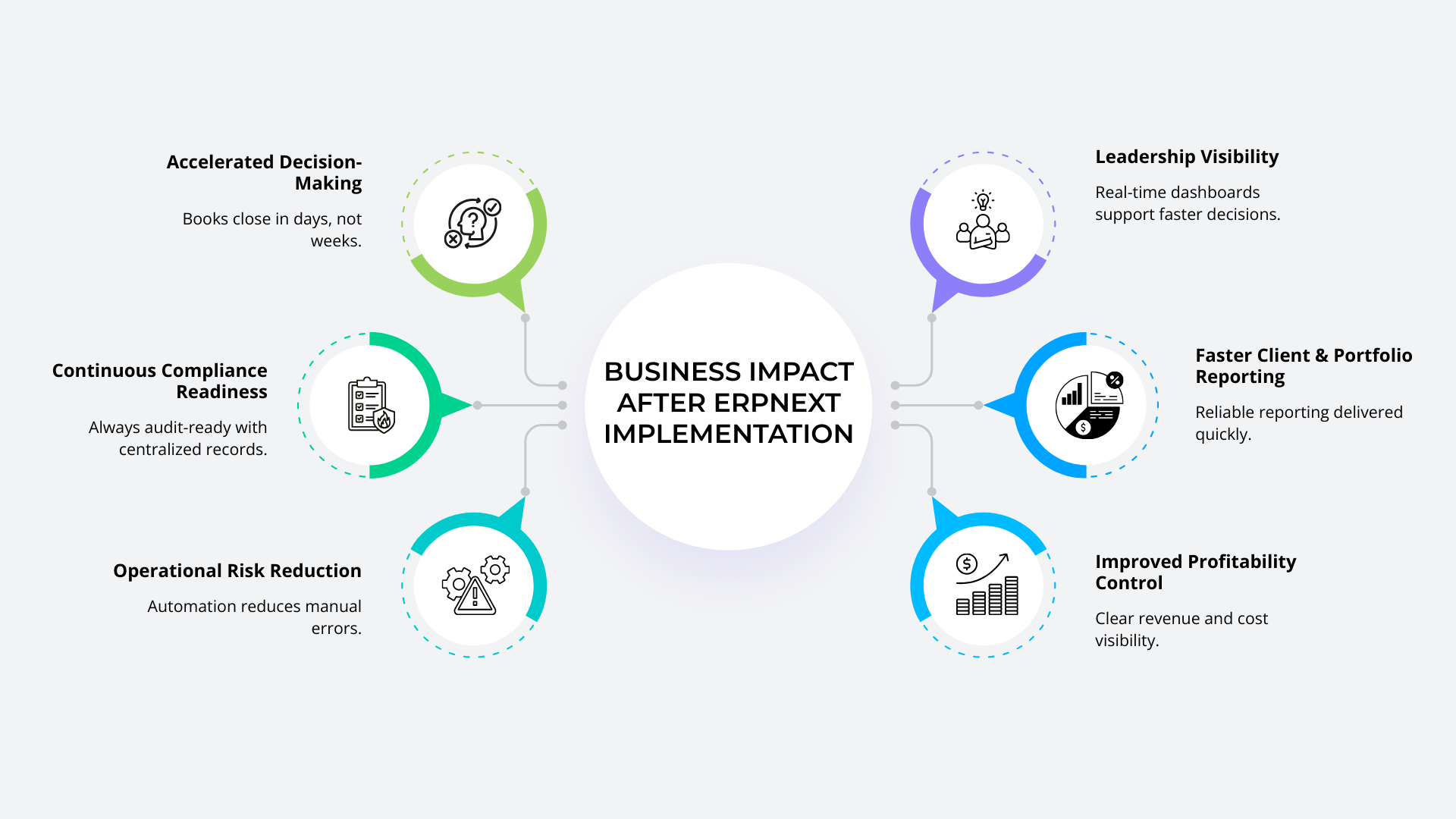

Business Impact After Implementation

Organizations implementing ERPNext commonly experience measurable operational and financial improvements across departments.

- Accelerated Decision-Making

Books close in days instead of weeks, enabling leadership to respond faster to market shifts and strategic opportunities. - Continuous Compliance Readiness

Centralized financial and operational records eliminate last-minute audit pressure and improve regulatory preparedness. - Operational Risk Reduction

Automated workflows reduce manual intervention, lowering the risk of errors across finance and operational processes. - Leadership Visibility

Real-time dashboards provide leadership with accurate, up-to-date insights, improving decision-making across functions. - Faster Client & Portfolio Reporting

Centralized data enables quicker, more reliable reporting for clients and investment portfolios. - Improved Profitability Control

Accurate cost and revenue tracking reveals true performance across services, portfolios, and client segments.

As a result, organizations operate with greater confidence, efficiency, and strategic clarity while building a scalable foundation for growth.

Score Your Compliance Readiness (1–5)

Assign one point for each capability that is fully implemented within your organization:

- Unified financial data across all systems

- Automated transaction audit trails

- Documented and enforced approval workflows

- Real-time dashboards accessible to leadership

- Role-based access controls protecting sensitive information

Your Score

4–5 Points: Your organization has a strong operational and compliance foundation in place.

3 Points or Below: Operational fragmentation may still be affecting efficiency, reporting accuracy, and compliance readiness, indicating opportunities for system and process improvement.

Gain Financial Operations Clarity

If fragmented systems or manual financial processes are slowing your firm’s growth, the next step is gaining clarity through a structured consultation designed specifically for financial services organizations.

Book Your Financial Operations Clarity Session

During your 60-minute consultation, you will receive:

✔ Analysis of operational bottlenecks affecting efficiency

✔ Compliance readiness assessment across financial workflows

✔ ROI and operational efficiency improvement projections

✔ ERPNext implementation roadmap aligned with your business priorities

There is no sales pressure, only a focused discussion aimed at delivering operational clarity and a practical path forward.